Grocery stores are in high demand in Washington, DC due to an increasing population and a focus on investments that provide fresh food options in the city. DC’s mixed-use neighborhoods offer access to both evening and daytime populations looking for convenient access to groceries and prepared meals. In addition, the city’s highly educated and diverse population provides significant demand for an extensive range of products and cuisines. Twenty new grocery stores have opened in DC in the past five years including more recent openings by Wegmans, Whole Foods, and Lidl.

FOOD AT HOME

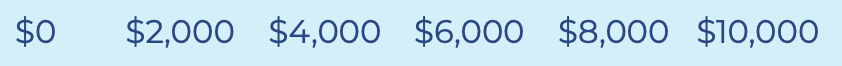

AVERAGE HOUSEHOLD EXPENDITURES

SOURCE: ESRI FORECASTS FOR 2022. AVERAGE HOUSEHOLD CONSUMER EXPENDITURES

Incentives & Resources*

SUPERMARKET TAX INCENTIVES

Through the Supermarket Tax Exemption Act of 2000, the District waives certain taxes and fees to eligible grocery stores that locate in specific neighborhoods. The incentive encourages development and investment in areas lacking access to groceries and fresh food. Qualifying supermarkets may be eligible to receive one or more of the following benefits for up to 10 years after development or renovation:

- Real property tax exemption

- Business license fee exemption

- Personal property tax exemption

- Sales and use tax exemption on building materialsnecessary for construction

ON THE JOB TRAINING

DC GREEN BANK

FOOD ACCESS FUND

NEIGHBORHOOD PROSPERITY FUND

*Subject to the availability of funds.